The Illinois Constitution allows villages to adopt home rule which shifts greater authority and decision making from the State of Illinois (Springfield) to the local community (River Forest). Currently, as a non–Home Rule unit of government, the Village of River Forest’s powers are limited to those the State of Illinois allows local municipalities to exercise. Home Rule communities are free from various state–imposed regulations and may exercise a greater range of responsibilities to benefit their residents.

Under the Illinois Constitution a community becomes Home Rule in one of two ways:

1. By population – Communities in Illinois with a population greater than 25,000 automatically have

Home Rule authority.

2. By referendum – Communities in Illinois with a population of less than 25,000 may become

Home Rule by voter approval via a referendum.

The Village of River Forest Board of Trustees passed a resolution to place the question of whether the Village should become a Home Rule unit of government on the November 2012 ballot. Voters in the Village will decide whether the Village becomes Home Rule by voting on the referendum question in the November 2012 election.

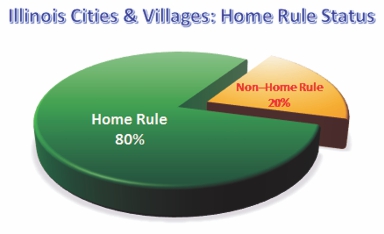

Eighty percent of all Illinois citizens live in the 209 Illinois communities are Home Rule. Most of these cities and villages adopted home rule by referendum.

Communities with similar demographics as River Forest:

Deerfield* | Lake Barrington* | Lincolnwood* | Riverwoods* |

Glenview | Lake Bluff* | Mettawa* | South Barrington* |

Highland Park | Lake Forest* | Northbrook | Wilmette |

Inverness* | Lincolnshire* | Northfield* | Winnetka* |

Nearby communities: Bellwood* | Elmwood Park | Hodgkins* | Oak Park |

Berkeley* | Elmhurst | Maywood | Oakbrook Terrace* |

Berwyn | Forest View* | McCook* | River Grove* |

Cicero | Harwood Heights* | Norridge* | Schiller Park* |

Countryside* | Hillside* | Northlake* | Stone Park* |

The Village placed the home rule referendum on the ballot to let voters in the Village decide whether the Village should, or should not, become a Home Rule unit of government.

Home Rule municipalities have additional authority to address local problems, and are protected to a greater degree from State mandates. Home Rule municipalities have opportunities to operate in a more cost–effective manner, have opportunities to have a more diverse and flexible revenue base, and have an opportunity to reduce their dependency on property taxes.

The Village proposes to address the following four areas if it becomes Home Rule:

• Long–Term Financial Stability

• Maintaining Property Values & Character of the Community

• Economic Development

• Reducing Regulations and Interference from the State of Illinois (Springfield)

Home Rule municipalities are not subject to the property tax cap, and as such Home Rule municipalities do not need voter approval to raise property taxes in excess of statutory limits. However, with tax caps, municipalities often increase their property tax levy each year to the maximum limit allowed under the tax cap, so that the municipalities do not lose their ability to levy that amount in the future. With Home Rule, municipalities may limit their property tax levy increases in a given year because of their financial flexibility.

The Village has worked diligently over the past several years to right size its operations. At this time, the Village is staffed appropriately to provide basic police, fire and public works services, and does not have any plans to increase the size of government or expand the scope of operations.

Home Rule status can be used to shift reliance by municipalities from property taxes to other revenue sources, such as gasoline taxes or head taxes.

In September of 2012 the Village Board of Trustees adopted an Ordinance that self–imposes a property tax cap on the Village, should the Village become Home Rule. This Ordinance provides that the Village may not increase its property tax levy in a given year by more than 5% or the Consumer Price Index, whichever is less, on a year–over–year basis. The only exceptions to this limitation are for a bona fide emergency (such as a natural disaster), a new unfunded mandate from Springfield or a new reduction in shared revenue from the State of Illinois. The Village may use an exception to increase its property tax levy in a given year after holding a hearing that is published in the newspaper, and upon the vote of 5 out of 7 of the Village’s President and Trustees.

The Village has no current plans to adopt a real estate transfer tax if it becomes Home Rule, which would require a separate referendum, even if the Village were Home Rule. While the Village already has a transfer tax calculated at $1.00 for every $1,000 of value, any changes to this tax, even if the Village were Home Rule, would require a separate referendum that would have to be approved by River Forest voters.

Home Rule municipalities often levy non–property taxes to raise revenue, and sometimes offset their property tax levies with that additional revenue. If average rates used in the area were implemented in River Forest, the following additional revenue could be expected to be generated, if the Village were Home Rule:

• Employer Head Tax

o A $5/monthly tax on employers with more than 350 employees……….$100,000 (This would only apply to Dominican and Concordia Universities)

• Gasoline Tax – a $0.05 local tax would generate approximately......................$80,000

• Liquor Tax – a 3% local tax would generate approximately……………………………$45,000

• Enhanced Food & Beverage Tax – a 1% tax would generate approximately…..$10,000

These taxes are more likely to be paid by non–residents of a Home Rule municipality, as opposed to residential property taxes which are exclusively paid by residents.

• Participate in elections

o 50% of Trustees are elected every 2 years

o The Village President is elected every 4 years

• Participate in Board of Trustee meetings

o Public comment is permitted and invited on agenda and non–agenda items

o All ordinances are published, discussed and acted upon in open session

o All agendas and ordinances are posted on the Village website at least 48 hours before a

vote

• The Village President and Trustees are River Forest residents, serving as unpaid volunteers and are personally affected by Village Board actions

• Voters can file a petition to rescind Home Rule by referendum

To learn more about the Home Rule referendum visit the Village’s website at www.vrf.us.

Informational meetings will be scheduled throughout October. Check the Village website for specific dates and times.